Researching Retirement Destinations

“In 1994 I moved my young family to Sequim, WA after a lot of research. It was the best decision of my life.” - Chuck Marunde

Introduction:

When deciding where to retire, it's important to carefully research potential destinations to find the best fit for your lifestyle, budget, and needs. Consider factors such as cost of living, climate, access to healthcare, proximity to family and friends, tax environment, safety, political climate, and available amenities and activities that match your interests.

Exploring Local Culture and Community

Local culture plays a vital role in shaping community identity, traditions, and values. Immersing in local culture involves exploring oral stories passed down through generations, visiting landmarks like historic buildings and parks, and participating in community events and festivals. Through rituals, ceremonies, and creative expressions, communities uphold their cultural heritage, fostering a sense of identity and belonging. Local culture is also crucial for securing asset portfolios in rural communities, enhancing social assets, and strengthening solidarity. By engaging with local culture through shopping at markets, trying regional cuisine, and interacting with residents, travelers can gain a deeper understanding and appreciation for the unique character and traditions of the places they visit.

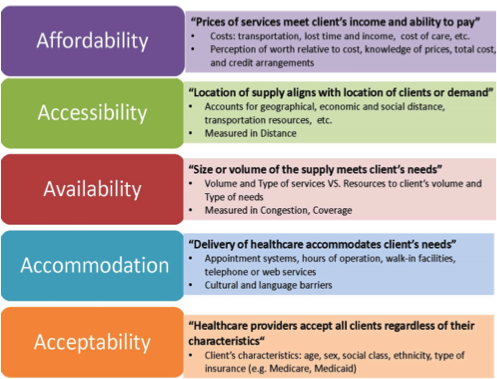

Assessing Healthcare Quality and Availability

When evaluating potential retirement destinations, assessing the quality and availability of healthcare services is crucial. Service availability measures the extent to which specific health services are offered and available, while readiness examines if facilities have the necessary guidelines, equipment, diagnostics, medicines, and competent staff to deliver high-quality care. Health facility assessments can help identify gaps and areas for improvement at individual facilities or nationally. Quality indicators, such as effectiveness, safety, and patient-centeredness, provide a framework for measuring healthcare quality. Interpreting assessment results allows policymakers and facility managers to target areas where facilities can enhance readiness and quality. Evaluating patient satisfaction, in addition to including doctors, nurses, and technical staff in assessments, provides a comprehensive view of healthcare quality. Ultimately, a location with accessible, high-quality healthcare services that meet your specific needs is essential for a healthy and secure retirement.

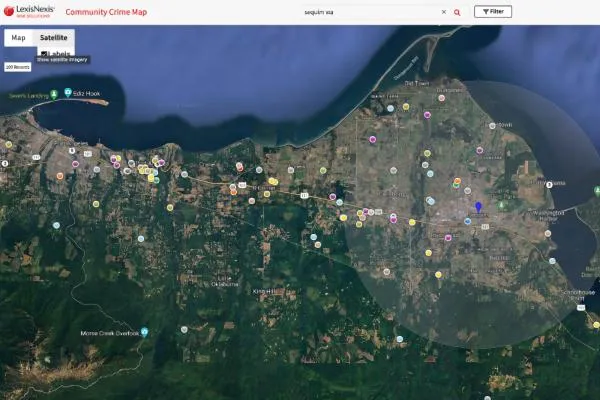

Evaluating Safety and Crime Rates

When evaluating potential retirement destinations, safety and crime rates are key factors to consider. While no place is completely crime-free, some cities have significantly lower rates of both violent and property crime, providing greater peace of mind. Sleepy Hollow, New York boasts a violent crime rate of 0.0 per 1,000 residents and a property crime rate of just 0.083. Other notably safe options include Pinehurst, North Carolina, which topped one list of secure and affordable retirement spots, and Montpelier, Vermont, the state capital, which offers a high livability score along with low crime rates. College towns like Lexington, Massachusetts and State College, Pennsylvania also tend to have lower crime rates and a reasonable cost of living for retirees. When assessing safety abroad, consider factors beyond crime, such as quality of healthcare, political stability, and risk of natural disasters. Regardless of destination, taking common-sense precautions like locking doors and not leaving valuables unattended can help retirees fully enjoy their golden years with less worry.

Retirement Living Costs

The cost of living is a crucial factor for retirees when choosing where to settle down. According to the U.S. Bureau of Labor Statistics, the average retiree household spends around $50,000 a year on living expenses. However, this varies significantly by state, with a comfortable retirement costing as little as $55,074 annually in Mississippi and as much as $121,228 in Hawaii. Factors like housing, healthcare, transportation, food, and entertainment all contribute to the total cost. While some expenses, like commuting costs, may decrease in retirement, others, such as travel and leisure activities, may increase. Taxes also play a major role, with income tax rates impacting withdrawals from retirement accounts. Ultimately, carefully estimating and managing retirement expenses is key to ensuring you have sufficient resources to enjoy your desired lifestyle. Moving to a retirement community can be a cost-effective way to bundle expenses and make the most of your retirement budget.

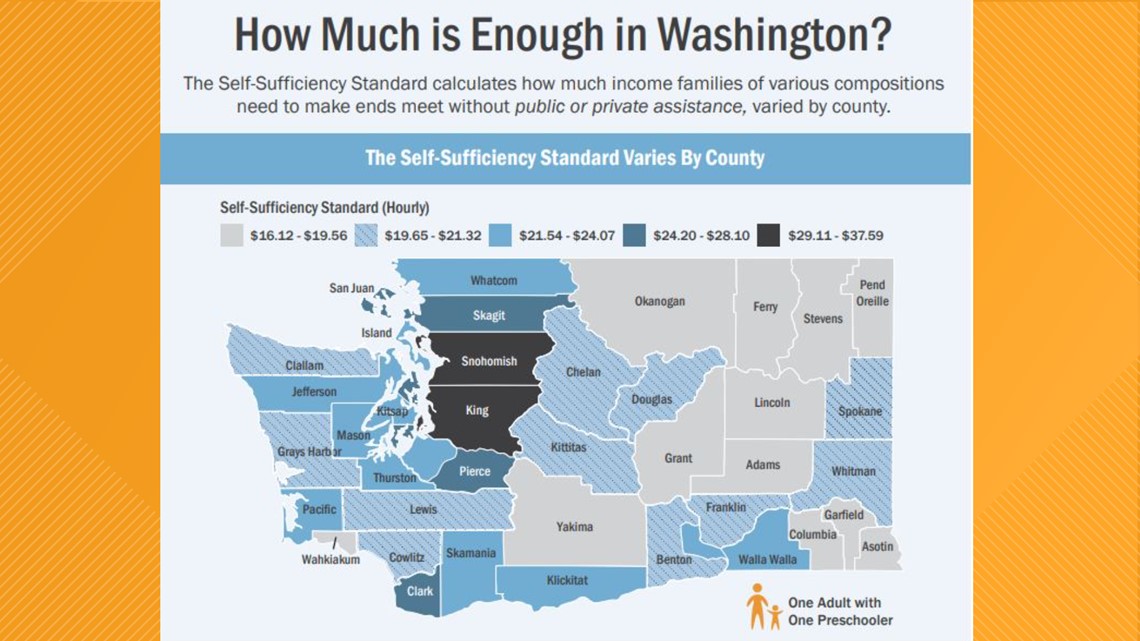

Washington Retirement Costs

The cost of living for retirees in Washington State is 17% higher than the national average, with housing costs 29% above the U.S. median. A single person's estimated monthly expenses, not including rent, are $1,346.70 in Washington. The average salary needed to live comfortably in the state was $56,618 as of 2019, but this varies widely by county, with King County having the highest average wage at $92,095. Among major cities, Seattle's cost of living is 45% higher than the national average, while Spokane and Kennewick are closer to the U.S. median. For retirees on a fixed income, housing and healthcare costs are particularly important considerations. Washington ranks 48th out of 50 states for living expenses like groceries, rent, and utilities, with an average monthly cost of $1,842. Healthcare services such as doctor visits and insurance premiums are also 20% higher than the national average. Researching specific cities and regions within the state and comparing costs to retirement income and savings is crucial for making an informed decision on where to retire in Washington.

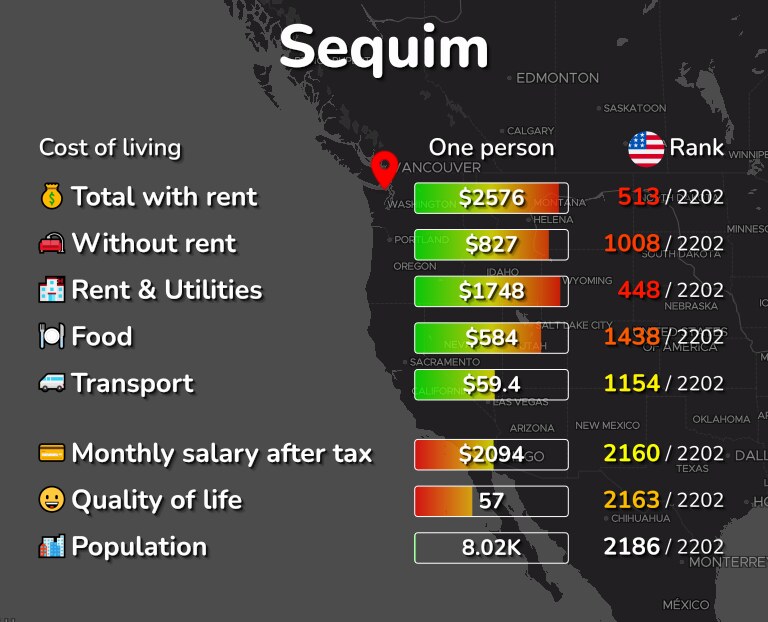

Sequim's Cost of Living

The cost of living in Sequim, Washington is slightly higher than the national average, with an index of 109 compared to the U.S. baseline of 100. Housing costs are 25.2% above the national median, with the average home price at $231,200 and average rent at $959 per month. Groceries, healthcare, and transportation expenses are also higher in Sequim, at 18%, 23%, and 14% above the national average, respectively. However, utility costs are 30.4% lower than the U.S. average.For a single adult, the total annual cost of living in Sequim is estimated at $32,572, which is less than the overall Washington state figure of $38,410. Approximately 40.6% of homes in Sequim are rented, with a typical monthly rent of $933, slightly higher than the $1,023 national median. Food costs for a single adult in Sequim average $3,185 per year, compared to $3,240 nationally. Taxes are relatively low in Sequim, with the average adult paying $4,602 annually in state and federal income taxes, Social Security contributions, and Medicare payroll taxes.

I hope you find this article useful. It was fun putting it together, and you can participate in a unique way. You can ask additional questions or follow-up questions to this article and get instant AI (artificial intelligence answers). All you have to do is go to this link: